Compliance is such a pain.

It’s the end of the quarter again, and you are trying to conduct the review process for personal trading activity.You need to manually send account statement requests to each person who has access. You gather the relevant .PDFs, and send out the emails one by one.

Then you have to keep track of all these requests. Which person responded? Who do I need to follow up with?

You download each series of attachments as people respond, and you carefully save each one to the right location on your desktop. You mark activity that needs more attention and keep a list of flagged items on a separate digital tool.

Does this sound familiar?

Handling compliance requirements can be one of the most tedious and frustrating parts about starting and growing an RIA. It can be a major time sink and take away valuable resources from the more important goal: retaining former clients, earning new clients, and growing your practice.

We see financial advisors at new, small, or mid-sized RIAs run into this issue all the time. What can you do?

One of Vantage Impact’s network partners in the industry, Joot, uses technology to help solve these compliance and regulatory issues.

How does Joot help advisors and RIAs with compliance needs?

Joot helps financial advisors and leaders of small to mid-sized RIAs manage compliance and regulatory issues through a technology platform and consulting services.

Compliance Technology

Joot’s technology platform features three basic modules and two advanced modules. The basic modules include a compliance calendar, document manager, and workflow tool. The advanced modules include a Policies Manager and a Personal Trading Manager. (Plus, Joot is close to launching an advanced trade analytics tool that will make the review of employee transactions faster and better.)

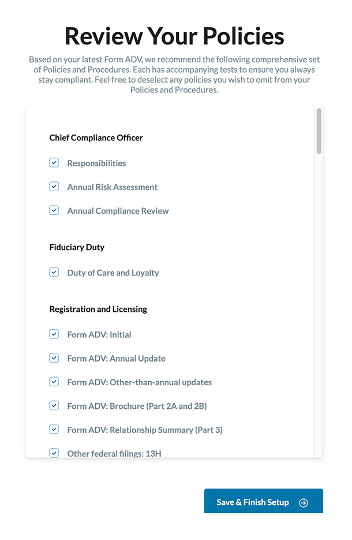

Policies Manager

Joot’s Policies Manager tool allows advisors to quickly and efficiently generate a Policies Manual for their practice. Following your latest Form ADV, the tool automatically recommends which policies and procedures should be included. After your selections and revisions, it generates a new manual for your practice, keeping your policies up to date. The tool simultaneously sets up your compliance calendar for the year with deadlines and reminders. Never miss another deadline again.

Joot’s Policies Manager tool auto-generates Policies and Procedures based on your latest Form ADV.

Joot’s Policies Manager tool auto-generates Policies and Procedures based on your latest Form ADV.

Personal Trading Manager

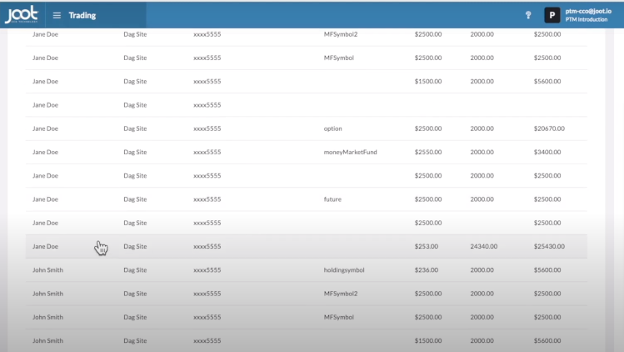

The Chief Compliance Officer (CCO) can use the Personal Trading Manager to simplify the pre-trade and regular reporting process.

Advisors and other employees are given access to the Personal Trading Manager tool, and they can link directly to their institutions. The trading manager automatically populates the tool with the transaction and holding data and pertinent information needed for compliance from their institution. This allows all of the information from everyone’s account to appear in one place.

With all of the data in the dashboard of the Personal Trading Manager, the CCO can then run an automatic consolidated transaction or holding report, ensuring compliance without the tedious, manual steps described in our example at the beginning of this article.

In addition to generating reports, the CCO can identify restricted securities and streamline pre-trade requests using the tool. Before the security being traded, the employees or other advisors submit a request that automatically shows up in the CCO’s dashboard. The CCO can then choose to approve or deny the request with a message. Any securities on the restricted list are automatically denied.

The Personal Trading Manager can be used by RIA leaders and CCOs to quickly deal with compliance and regulatory requirements, so they can focus on other matters in their practice.

With Joot’s Personal Trading Manager, Chief Compliance Officers can view all client accounts in one place, easily running consolidated reports for end-of-quarter reporting.

With Joot’s Personal Trading Manager, Chief Compliance Officers can view all client accounts in one place, easily running consolidated reports for end-of-quarter reporting.

Other Technology Features

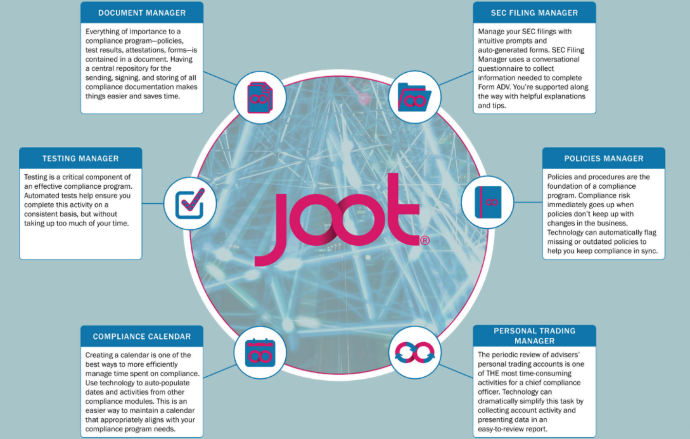

In addition to the Policies Manager and Personal Trading Manager, Joot’s suite of compliance tools includes a Document Manager, Testing Manager, Compliance Calendar, and SEC Filing Manager.

Joot’s suite of compliance technology tools can be used by RIA leaders and Chief Compliance Officers (CCOs) to streamline advisory compliance guidelines. Check out a full brochure here.

Joot’s suite of compliance technology tools can be used by RIA leaders and Chief Compliance Officers (CCOs) to streamline advisory compliance guidelines. Check out a full brochure here.

Compliance Consulting Services

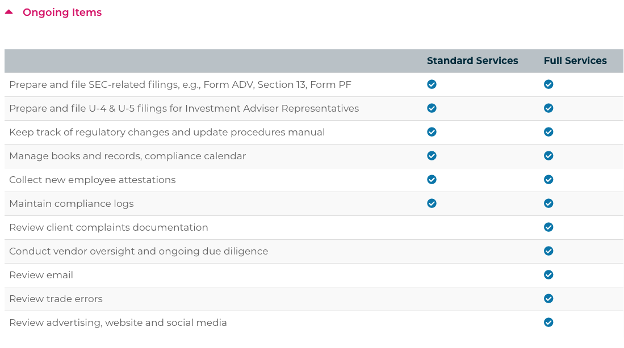

Joot’s team of compliance, auditing, and risk management experts offers various packages for advisors looking to outsource compliance and regulatory services.

Standard Services:

RIA leaders and advisors looking to establish a foundational compliance program may engage Joot’s standard services for basic support. The basic services cover major items like annual review of policies and procedures and the Form ADV update.

Full Services:

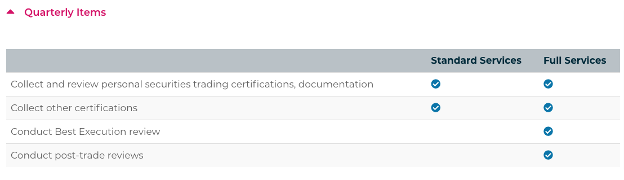

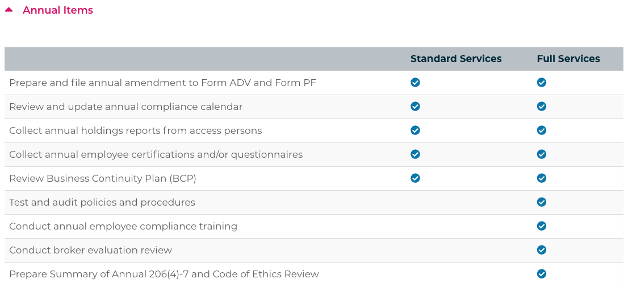

The full services package enhances the standard services package, adding more comprehensive critical activities and requirements. Think of it as having an entire compliance department dedicated to your business. Joot can manage your monthly and quarterly tasks, in addition to the big annual requirements.

CCO Services:

For RIAs and firms in need of a full named Chief Compliance Officer, Joot provides this option including Registered Fund Services.

Mock SEC Exam Services:

RIAs looking to get the RIA compliance program exam ready may consider this option. A periodic mock exam is a great way to prepare for your next SEC exam and to identify any weaknesses or gaps before the SEC does.

RIA Registration Services:

New RIAs or advisor teams considering breaking away from the wirehouse and forming an RIA may find the RIA registration service offerings helpful. Joot can help with the entire registration and compliance setup processes.

Standard vs. Full Services: What’s Included?

For more information about the various service packages, visit Joot’s website here or check out the images below.

Vantage Impact Takeaways - Joot

As they say, time is money, and this is particularly true in the financial services industry, when you have decided to take the leap and breakaway to start your own RIA.

Maintaining compliance requirements can be a challenge and can quickly take over your monthly operations if you do not have a plan.

Depending on your firm’s size and compliance needs, there are outsourced compliance providers like Joot who can offer both consulting services and an intuitive technology platform to make your life easier.

For those who are considering making the move to start a new RIA, we recommend advisors work with Joot early on in the transition process. While compliance won’t be on the top of most RIA leaders’ minds, it can quickly become an issue if not thought through as part of an overall strategic process.

If you’d like to talk about starting a new RIA and whether or not you could benefit from outsourcing compliance services or a full Chief Compliance Officer, schedule a consultation here. We’d love to talk to you and help you start exploring your options.